投资宝石

投资宝石。

首先,这并不是针对个人的投资建议。请勿投入超过您能承受的损失的金额。投资及其收益可能上涨也可能下跌,您获得的回报可能低于您的投资额。

如果您想明智地投资宝石,以下是一些建议。首先,宝石种类繁多,从知名的到稀有的,甚至更不寻常的,应有尽有。宝石的价值取决于不同的属性,而这些属性因品种而异。我们强烈建议所有购买的宝石均需经认可的宝石检测实验室的宝石学家认证。

数千年来,人们一直通过处理来提升宝石的外观。如今,宝石的处理方式多种多样,因此,了解宝石是否经过处理以及处理的具体类型至关重要。请阅读我们的宝石技术信息,了解更多关于您可能感兴趣的宝石及其处理方法的信息。

我们网站上的宝石价格与标准普尔 500 指数相比,平均每年上涨 22.4%,而同期标准普尔 500 指数的回报率仅为 11%,相比之下,宝石价格在过去六年上涨了 134.4%。

宝石投资越来越受到精明买家的青睐,他们了解认证宝石在市场上的重要性,以及编写这些证书的实验室的重要性。就连《华尔街日报》也撰写了一篇关于宝石和珠宝行业百亿美元年景的文章。

请阅读华尔街日报的文章-

价值100亿美元的珠宝行业笼罩在美丽与神秘之中。变革即将到来?

一般来说,宝石越大,价值越高——即使尺寸略有增加也会影响宝石的价值。宝石的颜色(在某些情况下是无色)以及净度与其价格直接相关。净度是指宝石内部净度特征或内含物的数量。内含物可以是任何物质,从微小裂隙到宝石中所含其他物质的晶体。这些净度特征通常在宝石形成时形成,但有些也可能在宝石开采过程中形成。

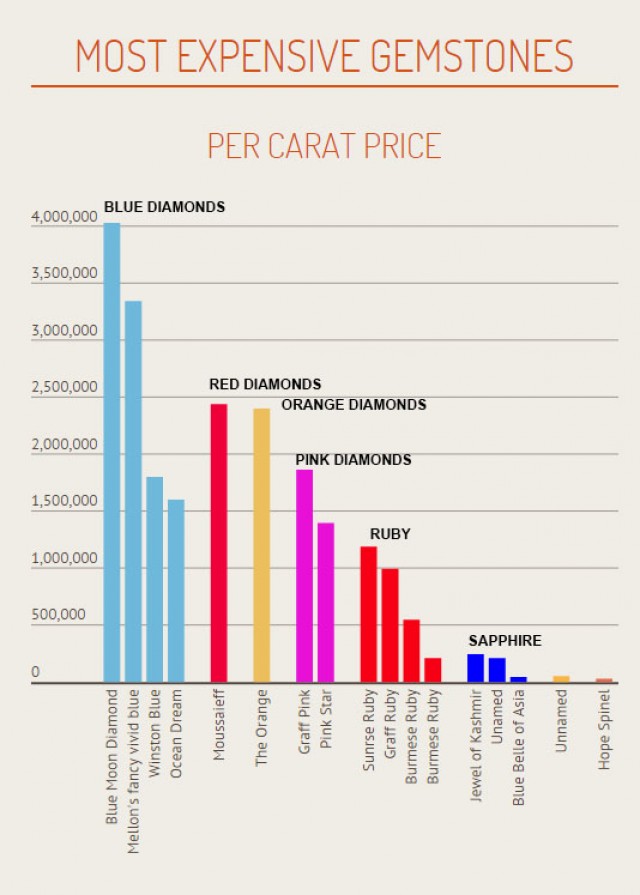

巨大、色彩浓郁、完美的钻石是地球上最珍贵的瑰宝之一。与贵金属一样,宝石的全球定价以美元计价。投资宝石被认为是一项高风险的交易,因为它可能带来成本效益,也可能损害投资者的收藏。您需要具备市场知识和耐心:

你必须能够识别珍贵宝石,并知道何时价值合适。有些投资需要你一段时间才能自动回本,而有些则需要数年时间才能盈利。有些投资者坚持投资,是出于对昂贵宝石的天生喜爱,而不是为了快速或轻松赚钱。只要有一定的分析和坚持,一个人就能收藏一套珍贵的宝石,从而获得可观的投资回报。当利率下降时,股市就会相当低迷。

此外,宝石看起来是一项明智的投资。它们易于管理,并且由于其固有的价值,始终能够保持其价值。天然宝石的供应一直受到限制,事实上,一些矿场已经被开采。许多宝石的价值正在逐渐升值,这并不令人意外。在世界许多地方,黄金、土地和宝石等资产比股票、债券甚至票据等软资产更受欢迎。如果您正在考虑将宝石作为投资,您应该注意宝石与黄金等硬资产之间的区别。

如果您拥有金条或金币,几乎可以在世界任何地方将黄金兑换成货币。另一方面,宝石与房地产非常相似,即使您想交易它们,也未必那么容易。您或许能找到买家,但您遇到的买家很可能是一位只愿意支付低价的投资者。

这将使您对宝石的流动性有一个很好的了解。黄金和宝石之间的另一个区别是,没有为宝石赋予重要性的标准。宝石可以由信誉良好的宝石学实验室进行鉴定,但这些实验室无法告知您宝石的价值。纯金在任何时候都有按质量计算的已知市场价值,但宝石的价值很难预测。投资宝石的理由如果您正在考虑投资宝石,那么您做出了一个明智的决定。投资珍贵的宝石比其他几种可能的投资机会更安全,有两个重要原因。首先,即使经济不稳定,在通货膨胀时期,宝石的价格仍会持续上涨。

这意味着,一旦您投资宝石,您的投资回报将始终保持乐观增长,且宝石的价值不会受到任何风险的影响。宝石投资风险较低的另一个原因是,它们的价值不受市场其他因素的影响。其次,购买此类宝石进行投资的关键在于确定宝石的来源。通常,投资宝石应该从批发商处购买,可以是单个宝石,也可以是批量购买。

宝石的批量购买效果很好,因为你购买的宝石越多,预期的回报就越大。事实上,你应该从批发商那里购买,主要是因为价格更便宜。从你选择的批发商那里购买宝石后,你需要将宝石储存一段时间。此外,在转售之前,你积累宝石的时间越长,你的投资回报就越高。当你转售宝石,或者用它们换取比你现有宝石更贵的东西,然后重新开始这个过程时,你的宝石就变得非常珍贵了。

如果您决定转售宝石,请记住,您有责任为超出实际购买价格的部分缴纳税款。如果您有兴趣投资一颗能够保值或增值的宝石,从而获得最大的“性价比”,那么您应该寻找一颗独特但目前价格不高的宝石,或者价格低廉但越来越受欢迎的宝石。

不过,宝石的性质也是影响因素之一,您还需要寻找切工和颜色特征都极为出色的宝石品种。一些宝石学家可能会认为,您今天可以购买任何宝石,然后在一年或五到十年后进行交易并赚取收益,但这很可能会造成损失。如果您没有足够的积蓄和常规投资,那么投资宝石或其他收藏品并不适合你。

然而,宝石市场给投资者/企业家带来了一些问题。首先,当你购买宝石时,很难准确地知道自己买的是什么,因为市面上有很多巧妙的宝石替代品和装饰,大多数都难以识别,即使是专家也难以识别。宝石的分级和定价也并非易事,需要丰富的知识和指导。其次,当你尝试零售宝石时,通常很难找到买家。

与金融市场、服务业甚至房地产市场相比,宝石市场的流动性极其低下。当每个人都想低买高卖时,出价和要价之间的差价通常很高。珠宝商通常会以2-3颗甚至更多的价格(不含成本)出售宝石,但他们不太可能以低于批发价一半的价格从普通公众手中收购宝石。即使找到潜在买家,他们也不愿给出正常的售价,而更愿意支付批发价。

显然,以零售价购买并以批发价交易不会给你带来任何收益。出于某些原因,如果你以真实的综合价值购买宝石,你就能保证物有所值。如果你谨慎挑选优质宝石,那么你可能会获得丰厚的利润。如果你有能力购买原石并自行切割,你的获利机会就会大大增加。

如果您能处理一定数量的宝石,而不是零星地购买,您的机会也会增加。出售宝石获利 宝石因其独特的魅力而价值连城,因此成为热门的投资选择。然而,它们并非适合所有投资者。投资天然彩钻的精髓 天然彩钻是世界上最珍贵的宝石,其价格以每克拉的价格计算。

例外的是,精美的彩色钻石没有固定价格,就像精美的画作一样,没有既定的定价规则。它们的真正意义只有在拍卖会上交易时才会被揭示。投资稀有彩色钻石被认为是一项长期投资。过去15年的金融周期中,由于价格记录失效,钻石价格屡创新高。二十年前,一颗粉红钻石的售价约为每克拉7万美元,而一颗价值50万美元的钻石则相当。天然宝石购买珠宝和宝石可能会让人感到困惑,因为即使是看似相似的珠宝,价格也相差甚远。

珠宝广告中使用的某些术语也可能令人费解,因为有些宝石被标记为天然、认证、合成、真品、处理、仿制、处理,以及这些词的组合。天然或认证宝石是作为环境馈赠而来的,未受人类干扰。在这样的环境下,它们在珠宝中变得清晰可见,虽然经过抛光或切割,但并未以多种方式被改变。

此外,它们是真石,是货真价实的宝石,但已不再是天然的,尤其是经过特殊处理以改善外观的宝石。此外,大多数珠宝生产商通过增强工艺,得以打造出消费者原本不会购买的宝石外观。与此同时,经过处理的宝石仍然是真石,但已不再被视为天然。如果只有“完美”的宝石可供选择,我们大多数人都买不起。

购买合成宝石时,它们虽然具有光学、化学和物理特性,但其制造过程是在实验室中进行的。这就像制作高级饼干,因为我们知道其成分,也知道烘烤时间。几乎所有流行的宝石都有仿制品,其中一些已经存在很长时间了。古老的合成宝石对于宝石学家来说很容易辨别,因为它们通常过于完美。一些现代的人造宝石看起来更为普通,也更难分类,但经验丰富的珠宝商或宝石学家通常可以对其进行分类。

包含优质人造宝石的珠宝,其效果可与天然宝石媲美。优质合成宝石并不总是经济实惠,但其价值应该低于同等品质的天然宝石。由于人造宝石的性质与普通宝石相同,因此可以正式称为真品,但这会被视为不可靠的标签,尤其是在宝石的来源尚未完全公开的情况下。

没有经过加热、着色和玻璃填充处理,只有数百万年前通过简单的自然过程产生的精美。

经过认证的天然宝石也因其稀缺性而被认为具有更高的市场价值。这些宝石难以言喻的需求、其美丽的色彩和内在的光芒,使它们对许多人来说弥足珍贵。事实上,它们的稀缺性、硬度和韧性更使其价值不菲。宝石的天然魅力、强度和坚韧度激发了人们对其超自然起源和神奇力量的信仰,而那些历经数个世纪而存留下来的宝石也积累了丰富的历史和传奇。此外,目前市场上大多数蓝宝石和红宝石都经过非天然工艺的精心修饰,力求展现大自然的馈赠。

缅甸拥有全球最优质的未经处理和加热的蓝宝石和红宝石,产自著名的抹谷矿区。与世界其他矿区大量出产的蓝宝石和红宝石不同,抹谷的宝石被认为是令人惊叹的、普通的美,无需任何修饰。

购买天然宝石的偏好既能满足个人需求,也能满足其标准。对某些人来说,经过认证的合成宝石通常就能满足他们的需求。而对另一些人来说,未经加热和处理的宝石就足够了。对于少数非凡的人士来说,只有一个选择:来自全球最古老的优质蓝宝石和红宝石产地的天然、未经加热和处理的认证宝石。一颗来自南亚尔塞克和抹谷的真正、非凡、纯天然的蓝宝石和红宝石。

正如大家所预料的那样,这些宝石也提供来自特定行业或宝石学实验室的真实性鉴定,或由买家自行选择,以验证其天然形态及其来源。如果您从值得信赖的宝石经销商处购买彩色宝石,卖家会保证宝石的真实性。在这种情况下,他们会证明某颗宝石是天然红宝石,产自缅甸,除简单的温度处理外,未经过任何处理。通常,经销商还会保证宝石的净度和等级。一些宝石经销商对其所宣传的宝石品种拥有丰富的经验。

有时,最有经验的卖家会用知名宝石实验室的认证来支持他们的保证。如果您购买的是昂贵的宝石,最好要求提供宝石学证书。宝石学证书的额外保障不仅能让您安心,还能在保险和未来转售方面提供帮助。很多情况下,高端宝石会附带宝石学证书。在其他情况下,商家通常会以较低的成本为宝石提供认证。

许多训练有素的宝石学家可以进行宝石分类,但最好还是让宝石在专注于宝石检测的宝石学实验室获得认证。因为优秀的宝石实验室能够提供最先进的高科技分析工具,并且他们有强烈的动机只出具准确且一致的检测报告。

由于需要维护市场地位,即使商家拥有宝石学研究生学历,商家出具的证书也作用不大。这是因为文件记录应由独立机构进行,且交易风险低。市面上也有一些不错的宝石学实验室。此外,一份合适的宝石证书应包含精确的尺寸、克拉重量以及宝石的照片。

证书应注明宝石种类的认可度,例如红碧玺和天然蓝宝石。证书中的一个重要部分是任何处理方式的说明,因为处理方式可能会对其价值产生相当大的影响。与其他网站相比,Gemsrockauctions 专营 2300 颗认证宝石,这些宝石因其稀有性和精美性而被视为独一无二的宝石。这些宝石非常适合打造传统作品或彰显其魅力的风格。

事实上,我们琳琅满目的宝石均附有独家评级报告,定能让您安心无虞。此外,报告还包含宝石的尺寸、形状和价值等详细信息。部分报告会简要介绍宝石的历史、处理方法以及一些实用技巧,帮助您在未来的岁月中保持宝石的璀璨光彩。提供这些详细信息,旨在帮助您更好地了解所购买的宝石。在 Gemsrockauctions,您可以安心无虞,因为您购买的宝石独一无二。我们的认证宝石附带专属识别码,进一步保障您的安全。宝石腰棱上镌刻有与评级报告对应的激光雕刻编号,该编号用于提供乐观评级。

此外,大多数宝石学家都是这些认证宝石的经销商,因为他们对所有宝石及其属性和价值都非常熟悉。他们可以识别、分析、分类、说明和验证每颗宝石的优越性和意义。

他们使用各种工具和设备,例如分级仪器和显微镜。我们保证,我们提供来自自律实验室的精准分级报告,并附上经销商的详尽描述。通过与最热门的宝石合作,我们能够构建一个强大且响应迅速的网络,从而在商业和宝石市场中高效且有利地竞争。推荐宝石:蛋白石http://www.opalauctions.com澳大利亚蛋白石被认为是一项长期投资,其价值逐年增长。大多数情况下,来自澳大利亚的游客回国时手上都没有蛋白石。在过去的几年里,买家们对蛋白石的产出感到谦卑。

如今,人们对珍贵纯蛋白石的投资价值有了进一步的认识。事实上,一颗品质上乘的黑蛋白石,其每克拉价格甚至比一颗品质上乘、普通的一克拉钻石还要高。在钻石行业,蛋白石的市场营销不受任何控制,市场供求关系决定了其价格。

澳大利亚的矿场正在逐渐枯竭,因此优质宝石的价格逐年上涨是合情合理的。此外,从供应地购买也同样合理,而且可以节省成本。一块澳大利亚蛋白石在进入零售店之前可能已经经过了五手之手,因此价格也随之上涨。目前,澳大利亚珍贵蛋白石是全球市场上最抢手、最成熟的蛋白石。

粉红钻石 产自澳大利亚的粉红钻石被认为是最稀有、最珍贵的钻石,每克拉价格也最高。粉红钻石矿是全球无与伦比的极致粉红钻石的重要产地,占全球供应量的90%。然而,只有极少数的钻石是粉红色的,实际上,只有不到千分之一的钻石属于粉红色。此外,粉红钻石年复一年地受到人们的追捧。然而,没有人能保证大自然能够持续供应这样的珍宝多久。

正因如此,粉钻作为个人投资的一部分,其重要性和精髓已足够彰显。粉红宝石或蓝宝石,色泽均匀,近年来逐渐被人们所接受。它的颜色多种多样,从略带橙色的帕帕拉恰到处可见;天然粉红蓝宝石已成为人们心目中价格最高的宝石。

粉钻的价格与其大小和色度息息相关。然而,未经处理的数克拉热粉钻却吸引了众多买家在矿场排起长队。粉钻的地位也随之提升。热粉钻产自斯里兰卡,常被用作礼物。由于其颜色范围广泛,从最娇嫩的婴儿肤色到令人惊艳的惊艳肤色,天然粉钻的评价难以简单概括。然而,浅粉钻尤其难以界定。与黄色一样,它们拥有夸张的内含物,散发着朦胧的光泽,仿佛在肉眼可见的地方留下了“窗口”。

事实上,粉红色钻石亲眼看到会让你屏住呼吸,因为它们很难用数码技术以吸引人的方式呈现出来。此外,坚硬的彩色粉红色钻石更加坚固。通常情况下,粉红色钻石的颜色被认为更为重要,你应该对任何你能察觉到的瑕疵保持警惕。你必须谨慎对待那些看起来过于透光的亮粉红色钻石,它们很可能就是这样。除非价格能反映出可检测的瑕疵,并且商家能给出具体名称,否则你可能会感到一阵不安。

. 大型3克拉钻石 在您投资大型3克拉钻石之前,您需要确保您的投资满足以下最低要求:价格透明性、转售流动性、推广渠道、质量证明文件以及专家指导。投资钻石的购买价格应该合理地接近您可以轻松地再次出售的价格。在交易市场购买,然后在批发商处转售并非明智之举,因此您需要联系一位能够为您提供全面了解全球经销商价格和市场的专家。

您还必须通过自主确定的第三方评级和专家验证来验证您投资钻石的卓越品质。一颗巨大而优雅的3克拉大彩钻,吸引了众多超级富豪收藏家的关注,它们价格低廉,价格透明度和转售流动性都不佳。除非您是百万富翁和/或专业的投资者,否则请避免购买任何惊艳的钻石。

事实上,它们的价格高度不确定,而且转售通常很复杂。传统上,钻石原石的价格由戴比尔斯集团控制,该集团的市场份额约为40%-50%。此外,博茨瓦纳目前是全球最大的钻石生产国(按价值计算)。1980年,其他制造商在澳大利亚、加拿大和俄罗斯等地开采新矿,挑战了戴比尔斯的领先地位(过去戴比尔斯的市场份额要高得多)。戴比尔斯通过其销售公司DTC与钻石市场互动。钻石价格差异很大,取决于其透明度、切工、克拉和颜色。与其他贵金属不同,钻石没有每克的全球价格。

该公司提供价格指南,例如Rapport Diamond Report、Price Scope等。此外,还有每月、每周或每季度出版的《宝石指南》。宝石专业机构拥有不断变化的标准,有助于钻石的分类和定价,例如HRD、GIA和IGI。这些机构专注于研究和教育,并将这些标准传递给公众及其会员。

总的来说,钻石并不稀缺。人造钻石的制造成本可能低于天然钻石,而且人造钻石的化学和结构净度也可能超越天然钻石。然而,化学结构并非决定其价值的唯一因素,切工的卓越品质也至关重要。

投资各种宝石 宝石总是令人难以置信,但事实并非如此,它们在光线照射下会闪烁。事实上,钻石、坦桑石、祖母绿、碧玺、蓝宝石和红宝石的真正吸引力在于我们的原则,即它们的稀缺性使得它们在魅力和价值方面都独一无二。我们将宝石视为长期的成本储存;选择钻石绝对不会错。如果生活顺利,你可以把它戴在手指上无限期地闪耀。如果生活不如意呢?那么,在危机时刻,还有什么比一把宝石更易于管理和流动的呢?这种说法有多少是真的?

在这种情况下,情况并非如此。长期以来,宝石确实是一种卓越的保值手段,因为它们提供了一种有效的规避物价上涨和货币波动的途径。与黄金和白银一样,珍贵的宝石很容易在所有货币中贬值其真实价值,甚至可以取代纸币。

此外,这并不意味着所有宝石都是绝佳的投资选择;宝石投资是一个雷区,充斥着各种合成宝石处理方法、价格操纵以及各种价格成分,这些成分远超预期,随时可能让那些业余投资者眼红。就拿钻石来说吧。你觉得它们不够吗?你必须三思。

此外,钻石储量丰富。每年都会产出数克拉钻石,随着新矿投产和其他矿场的扩建,自2005年以来,钻石产量预计将增至约1.2亿克拉。标准订婚戒指的重量远低于一克拉。毫无疑问,钻石储量充足,不仅足以供我们拥有一颗,而且几乎地球上每家新建的工厂都能堆放钻石。从地下开采出的钻石中,几乎有80%最终被用于工业。

钻石被认为是世界上最坚硬的天然材料。此外,根据莫氏硬度表,钻石的硬度高达10分(满分10分),这解释了为什么许多人以各种方式使用它们。这也解释了我们为什么开始用它们来订婚。每个人都应该记住“钻石恒久远”这句名言,正是这句话创造了钻石稀缺的传说,也创造了钻石无价的宝藏。所以,这些细节并不意味着钻石作为资产是“禁忌”。巨大或颜色鲜艳的钻石会损害其长期价值:目前,罕见的绿色、红色和彩色钻石的价值被高估。如果您决定购买钻石,请确保您的钻石确实有一些特别之处,确定其产地,并从信誉良好的商家或拍卖行购买。另一方面,蓝宝石和红宝石也确实能带来丰厚的回报。

它们的莫氏硬度均为9。它们也都属于同一种刚玉,但会根据岩石中的化学物质形成不同的颜色。然而,由于相对稀缺,它们在推测上都得分极高。

红宝石的主要产地是肯尼亚、斯里兰卡、泰国、坦桑尼亚、缅甸和越南。最好的红宝石产自缅甸,但如今缅甸的几座矿场已开采殆尽,政治动荡也导致供应中断。同样,最优质的蓝宝石也曾产自克什米尔,但自1925年以来突然断供。此外,所有这些因素都意味着优质宝石的价值极高。例如,几年前,一枚未经加工的克什米尔蓝宝石戒指将在邦瀚斯珠宝拍卖会上拍卖。它的成交价为1.7万英镑,而现在它的拍卖价在6万至8万英镑之间。然而,祖母绿的开采始于公元前330年,产自埃及,因此优质祖母绿的数量有限。这意味着市场上出售的大部分宝石都经过了加工,使其更加纯净。

20世纪80年代末,祖母绿制造商开始在祖母绿中注入树脂,以填补任何裂纹。坦桑石呈亮蓝色,自1967年以来在乞力马扎罗山麓被发现,据《泰晤士报》报道,其稀有程度远超钻石。坦桑石的供应仍然仅限于山峰附近仅5公里的土地上,其价值也被认为不稳定。尽管如此,坦桑石仍然很少被人们广泛认可,也被认为是极佳的投资选择。

同时,由于没有实验室仿制品,投资碧玺更容易,尽管玻璃有时会被轻信的人买到。碧玺投资最大的问题可能是选择太多。碧玺的珍贵品质依次为:颜色、光泽、光洁度、净度、性质和镶嵌。碧玺通常在世界各地开采。斯里兰卡、巴西和西南非洲的碧玺产量较大。其他产地包括肯尼亚、津巴布韦、尼日利亚、马达加斯加、坦桑尼亚、巴基斯坦和阿富汗。美国缅因州和犹他州也产碧玺。此外,世界各地都能找到丰富的碧玺矿床,但市场上很少见到品质优良、颜色绝佳的碧玺。

因此,碧玺的价格范围几乎与其颜色相匹配。购买碧玺时,务必询问处理方法,并寻找一位诚实的经销商,他们会对高价且具有投资价值的碧玺进行评估。然而,如今投资者同样注重宝石的风格和工艺。

大约100年前,工匠的年代不像现在这么重要,但这不意味着他们每件作品的交易时间比现在更长。通常,大多数在拍卖会上为您推荐这些作品的专家都会安排您进行分析,并能够提供详尽的信息,保证所有作品都经过知名专家的鉴定。筛选和竞拍需要花费大量的时间和精力,但这绝对是值得的。

再次强调,本建议并非针对个人或定制的投资建议。请勿投资超过您可承受的损失。投资及其收益可能上涨也可能下跌,您获得的回报可能低于您的投资额。

综上所述,祝您竞标和购买愉快!

搜索Gemstone Encyclopedia

最新的文章

文章分类

How To's is where you will find helpful articles from gem Rock Auctions on how to cut gemstones, select gemstones and buy gemstones.

9文章数